Document Retention - What do we have to keep in our files?

Compliance

Document Retention - What do we have to keep in our files?

What documents do we keep after a file closes? Can I just get a printout from my lender?

Last updated on 03 Nov, 2025

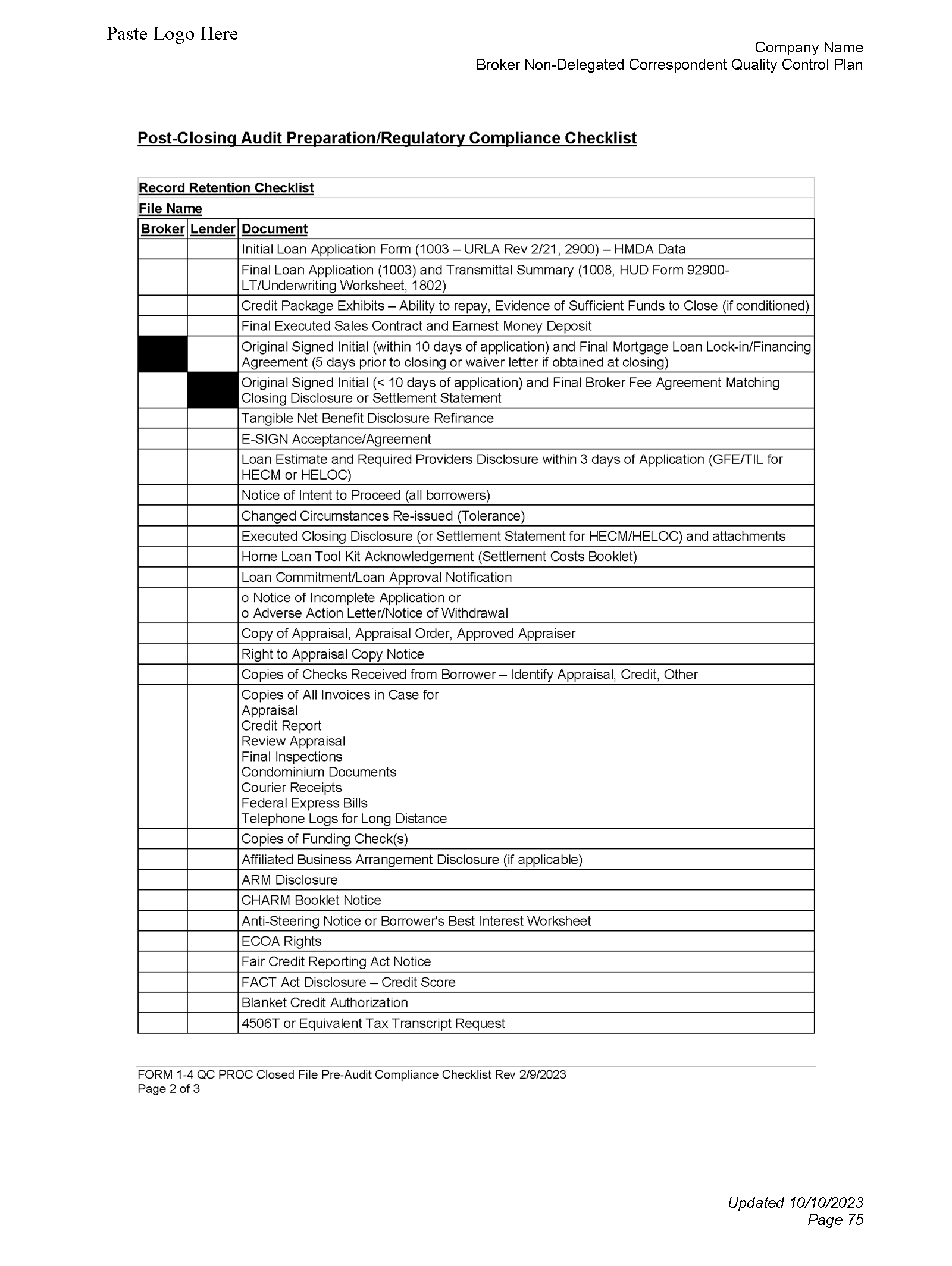

Please see your 1-A QC Plan > Section 6 - Financial and Compliance Audit. This is a document retention policy. This provides a list of documents required by all the states to be in each loan file. You need to ensure this list is populated by the state-specific disclosures your states require. Doing this on every loan will ensure you have all documents necessary in an audit.

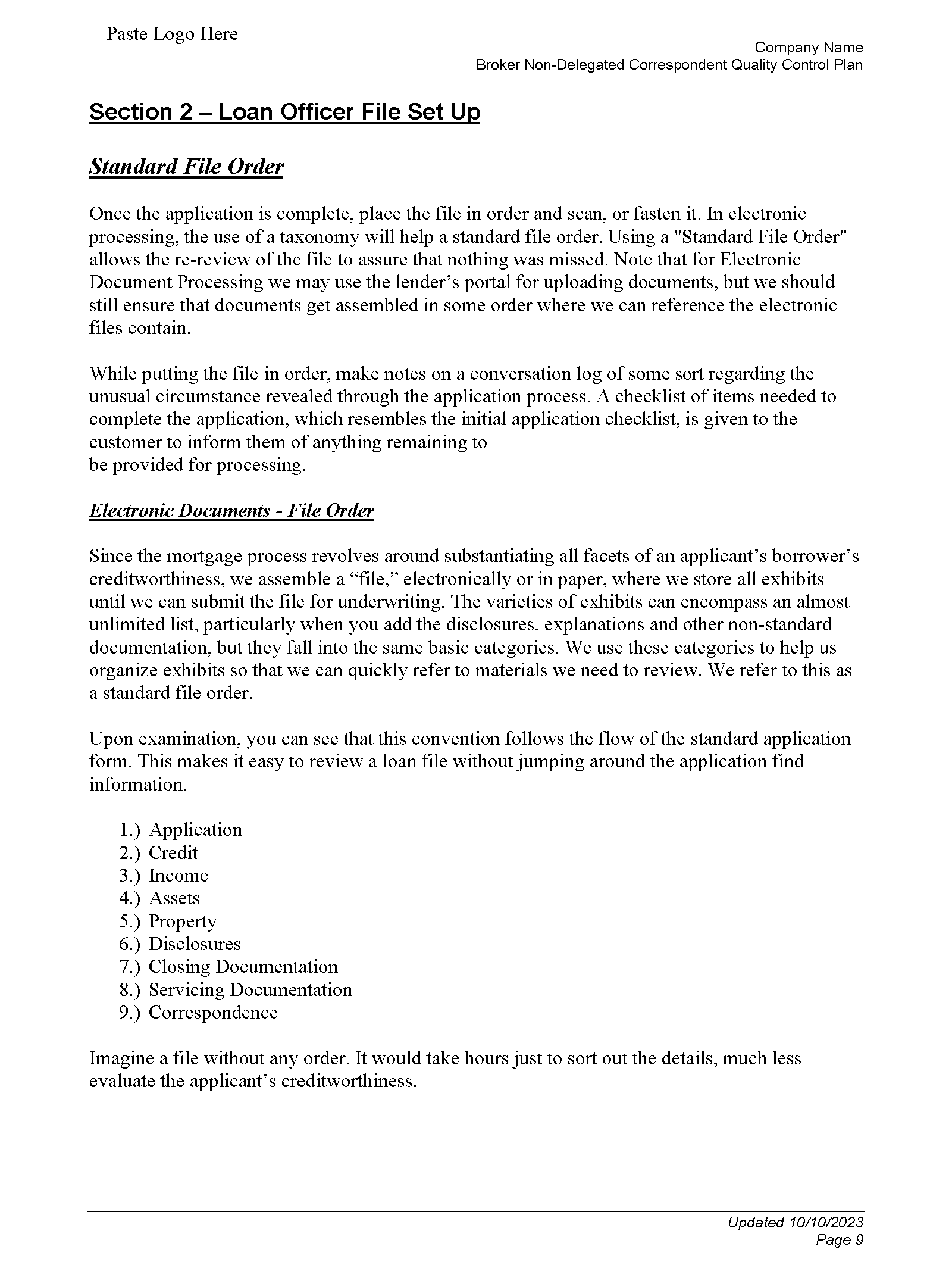

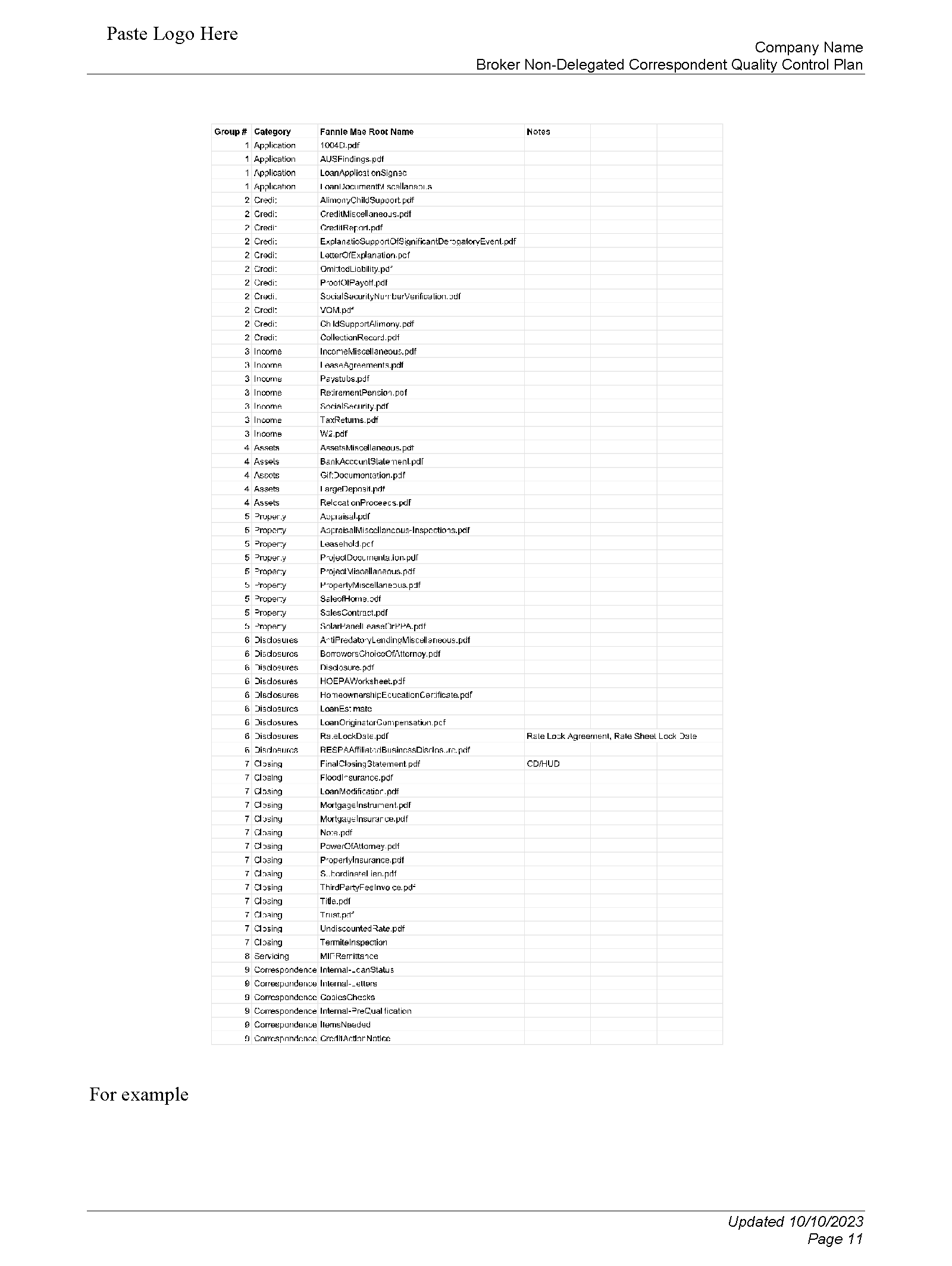

Also see our Loan File Set Up and Electronic Processing for taxonomy so your electronic loan files can be easily reviewed.

The lender's signed package will usually just contain closing documents, but will not contain some of the disclosures that you are supposed to collect, such as your broker fee agreement, copies of checks, the privacy notice, intent to proceed, appraisal credit card documentation, credit authorization, etc.

Also, the lender's closing package is usually a jumble, with documents in no particular order. The file should be properly stacked according to some sort of taxonomy, so you can easily validate that all required documents are in file without having to re-process the loan.