Compliance

Brokers - What disclosures do I have to send?

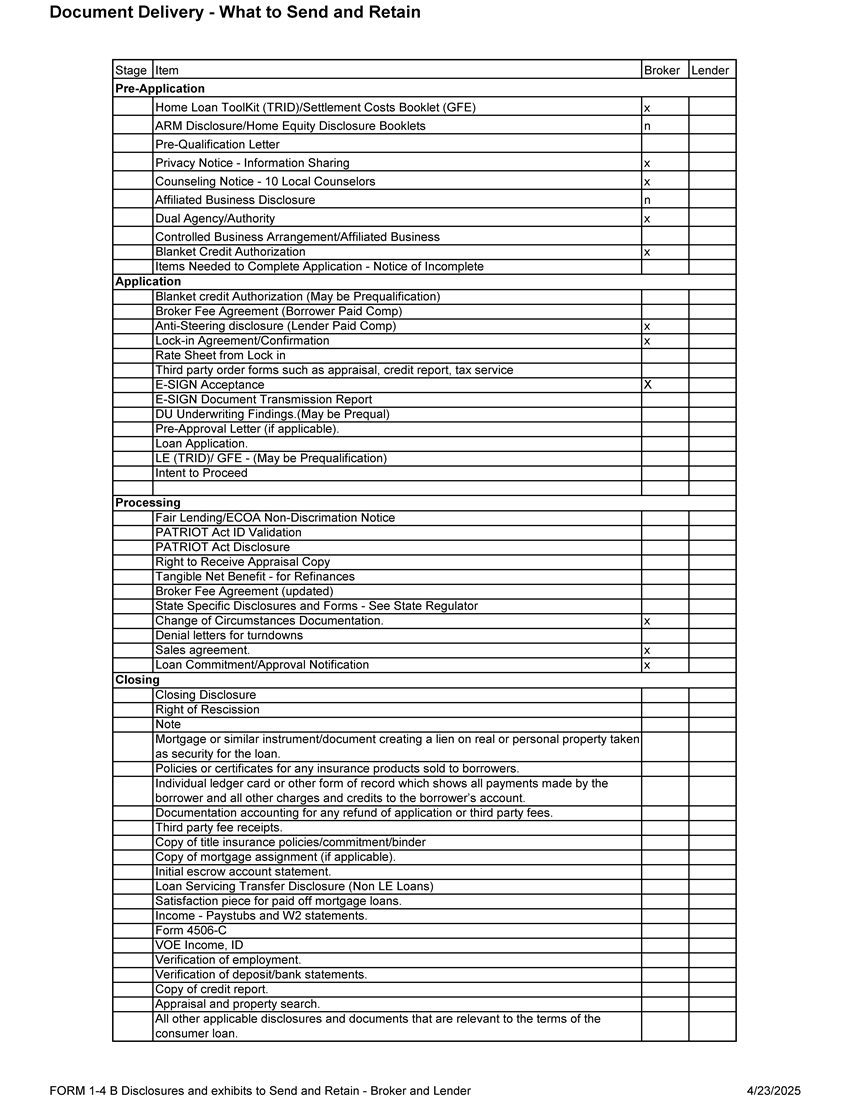

Lenders tell you "Don't send a disclosure package. We do that for you..." But what is missing from your lender's package that a state regulator will cite you for?

Last updated on 12 Nov, 2025

Mainstream wholesalers have done a fantastic job of picking up much of the slack for brokers regarding loan-level compliance. But there are gaps. The only way you know is to review the disclosure files that get sent.

To complicate matters, there are disclosures that BOTH lenders and brokers must have in file. It can be confusing to have two similar disclosures in a file, but certain disclosures must come from the party represented. The lender takes care of theirs; you must take care of yours.

There are timing matters to be concerned with, too. For example, brokers must send the privacy notice BEFORE sharing the borrower's information with the wholesaler. For another example, the broker agreement may be required to be signed before closing or may change if a customer's loan terms change. There are also situational documents you should retain, such as the complete application checklist or request for additional documentation, which becomes the formal notice of loan withdrawal if the customer does not respond.

Furthermore, there are times when you should issue a complete disclosure package, such as when conducting a pre-qualification and completing a regulatory application BEFORE registering a loan with a lender.

Both the broker and lender must likely complete any state disclosure. There are obvious exceptions, but to err on the safe side is prudent since the regulator will look for opportunities to cite your record-keeping.

Remember that you miss an opportunity to add referral business when you don't find local settlement service providers to include in your "providers you can shop for" disclosure.

Finally, remember that your state regulator may interpret what is required differently than your wholesaler, lender, compliance advisor, or federal regulator. So it's good to err on the side of caution. For instance, anti-steering disclosures aren't explicitly required when "someone other than the consumer pays the originator's fees." (borrower-paid) But regulators often still ask for anti-steering disclosure. Another example is the "Home Loan Toolkit," which isn't explicitly required for refinances, where the regulator still requires a "special information booklet."

Here is a reference for evaluating lender compliance when your lender packages go out. Once you have established the content and missing items, you can be more systematic about the forms you must get for the particular lender.

Examples of the disclosures you must generate on your own include:

Privacy Act Policy Notice Model Form - Yours AND Lenders

Affiliated Business Arrangement Disclosure

Fair Lending/ECOA

PATRIOT Act - ID Validation Form

FBI Fraud Warning

Blanket credit

Third-party order forms

Net Tangible Benefit (refinances)

Broker Fee

Ratesheet from Lock-in Date

Pre-Qualification / Pre-Approval

State Specific

Items needed to complete the application

Withdrawal Notice/Loan Denial

STATE-SPECIFIC Disclosure Forms

I have compiled a list in the QC plan of the Documents you must retain.

We have not taken an absolute position on this due to inconsistent messaging and implementation from various wholesalers and regulators. No one has established a national or state-by-state standard. Some lenders do ALL docs, some just some, and the timing and process vary for product-specific (e.g., HELOC, non-QM, etc.).

You can follow the AE's advice as long as you always immediately post-close your loans and ensure that your retain all the forms you must have for a regulatory exam.