Compliance

ECOA/Fair Lending - Cancel or Withdraw an Application

What do I have to do when an application doesn't go anywhere?

Last updated on 03 Nov, 2025

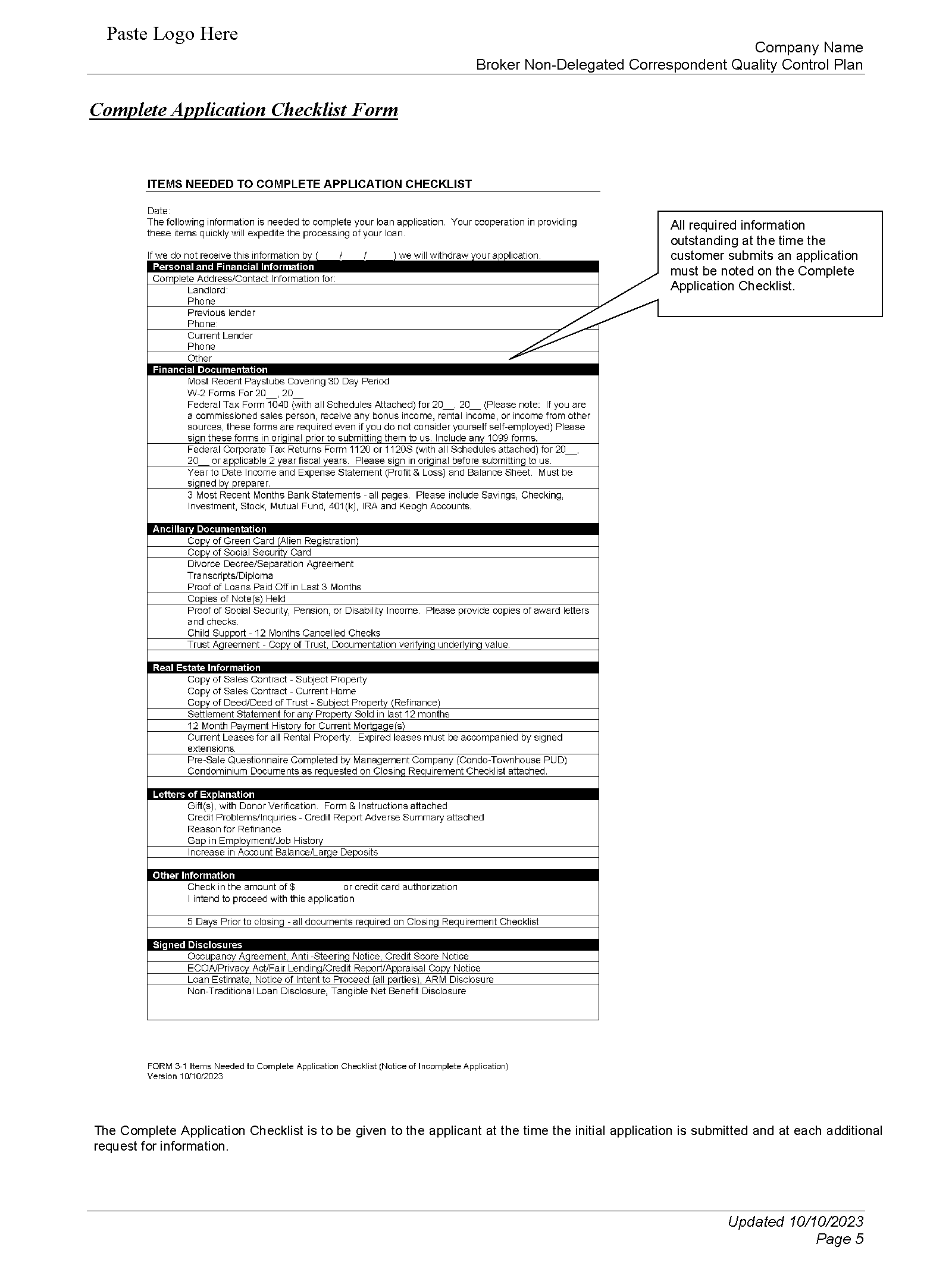

Please check your 1-A QC Plan > Section 1 - Complete Application Process. That shows your Notice of Incomplete Application. If you provide that to your customer, it states that the customer has 30 days to provide the information, or the application will be withdrawn for incompleteness. This is all you have to do.

Under Fair Lending Rules, the notice of incomplete application is the only notice required, provided you have dated it within 30 days of the request.

But you can also provide a withdrawal notice if you want. This is the standard Notice of Application Termination, Cancellation or Withdrawal that you may be familiar with. This is a usual form included in your Loan Origination System and it looks like this.

However, be sure to not act as a lender. Tf you do not typically approve loans directly, you should always use the incomplete application designation in lieu of listing other items. Issuing a denial, versus a withdrawal or cancellation, is a credit decision and making 25 or more credit decisions in a year means you must report HMDA data, which is requires substantial effort and carries significant compliance risk.