State Examination Support

Creating a California CRMLA Business Plan

California's Department of Financial Protection and Innovation's business plan request means answering some questions

Last updated on 03 Nov, 2025

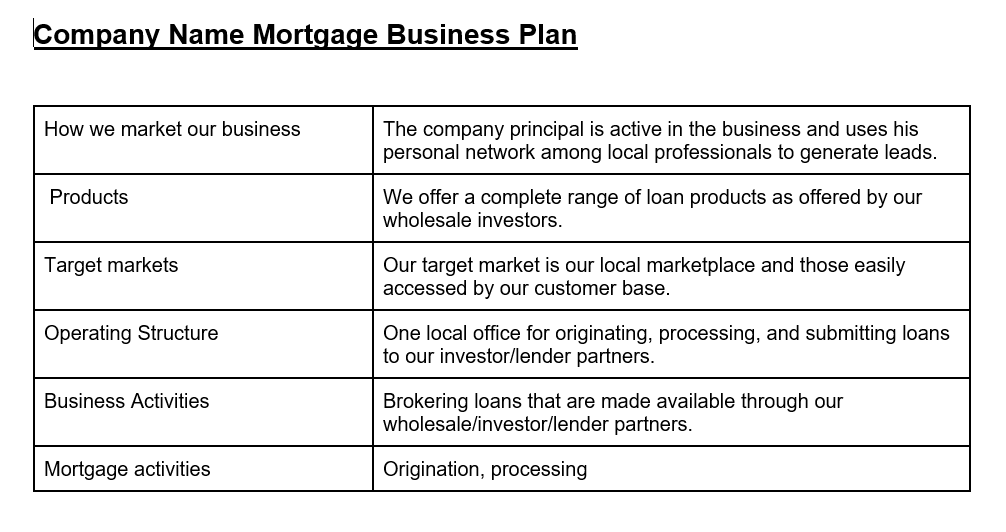

As with all business plan requests from a regulator, the request doesn't mean "write a business plan." The regulator wants answers to specific questions so they know how you plan to do certain things:

Use our "Regulatory Business Plan" template to answer these questions in any depth you feel is appropriate.

You can use our "Regulatory Business Plan or create this form using the regulatory required format:

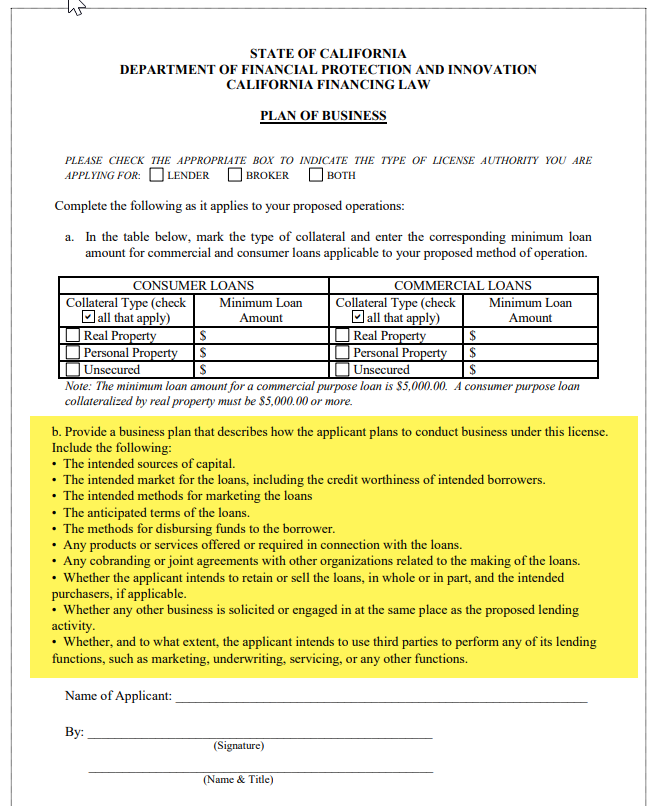

10. Complete the following as it applies to your proposed operations:

a. In the table below, mark the type of collateral and enter the corresponding minimum loan amount for commercial and consumer loans applicable to your proposed method of operation.

COMMERCIAL LOANS

CONSUMER LOANS

Collateral Type (check [TICK] all that apply)

Minimum Loan Amount

Collateral Type (check [TICK] all that apply)

Minimum Loan Amount

[] Real Property

$

[] Real Property

$

[] Personal Property

$

[] Personal Property

$

[] Unsecured

$

[] Unsecured

$

Note: The minimum loan amount for a commercial purpose loan is $5,000.00. A commercial purpose loan less than $5,000.00 is treated statutorily as a consumer purpose loan. A consumer purpose loan collateralized by real property must be $5,000.00 or more.

b. Provide the applicant's business plan, including information necessary for the Commissioner of Financial Protection and Innovation to understand the type of business that the applicant plans to conduct under this license.

See items above

Simply Sign has this form available.