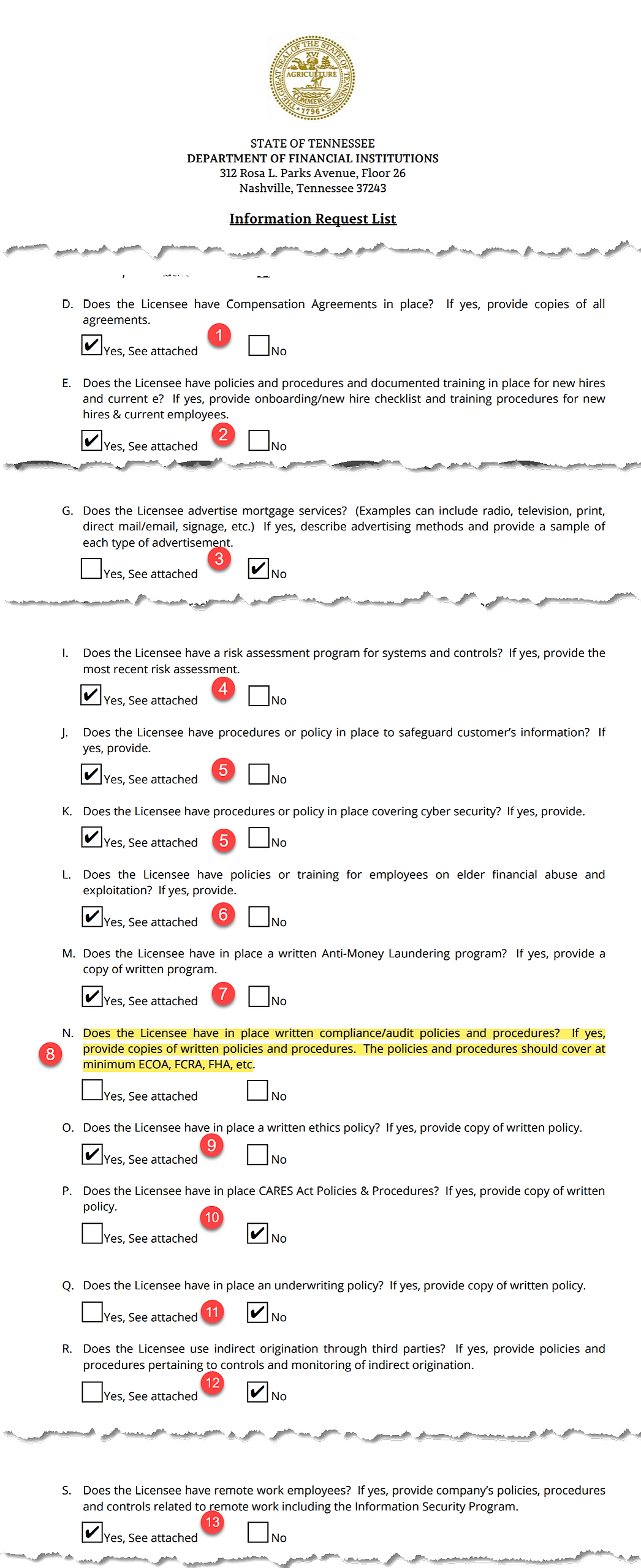

We provide a package of compliance policies and procedures. From these documents, we extract the ones that TN requires. Once we have located them, we print them to *.pdf format, naming the file to correlate with the request.

1.) Compensation Agreement - The request is for a compensation agreement, not a compensation plan. You can use the agreement/plan we provide in the Anti-Steering section of your 2-0 Compliance Module Section 2-72 > Loan Compensation / Anti-Steering

2.) Employee Training Program - This request is to identify the timing of your new and existing employees' training. See 2-0 Compliance > 2-72-4 Employee Training

3.) Advertising Samples - This request is to review your advertisements and whether your marketing is compliant. Remember, business cards, websites and social media posts are all forms of advertising. Use the checklist in your 2-0 Compliance > 2-34 Advertising to review your materials before you submit.

4.) Risk assessments can be performed by 3rd parties or internally. We have provided a Mortgage Industry Standard Risk Assessment which includes all operating areas, describes the risk, and how the risk is mitigated within your policies and procedures. See 1-0/A Quality Control > 1-80 Mortgage Company Risk Assessment.

5.) and 6.) Your customer Safeguarding Policy is really your IT Security Plan. The fact that they ask for Safeguarding and cybersecurity plans just shows the confusion over where IT and Cybersecurity intersect. They are one and the same. Locate your 2-0 IT Cyber Security Plan > 2-90 IT Security Plan and 2-91 CyberSecurity Risk Assessment.

7.) Written AML Policies and Procedures are a natural extension of Quality Control because you find suspicious elements in a loan file by reviewing loan documents. The progression is File review> suspicious document > SAR Report or > Fraud Report. See 1-0/A Quality COntrol > 1-70 BSA/AML SAR Reporting Plan.

8.) Compliance Audit/Policies and Procedures. This is a very wide open question. A strict answer would be to provide the policies and procedures for a compliance audit. But they seem to be asking for the entire Compliance Policies and Procedures stuck. Provide the entire 2-0 Compliance Module.

9.) Ethics policy. You can provide a code of ethics from your state industry trade association, or provide the Ethics Policy we provided in our 2-0 COmpliance Module > 3-84 Ethics Policy

10.) The CARES Act - has expired. N/A

11.) Underwriting Policy - if you are a lender, your credit policy is in 5-0 Underwriting > 5-20 Underwriting Quality Loans.

12.) For Wholesalers originating loans through brokers or correspondents, you should use the entire 3-5 Wholesale/Broker/TPO Policy

13.) Remote Work is in 2-9 IT Security > 2-94 Remote Work Policies and Procedures