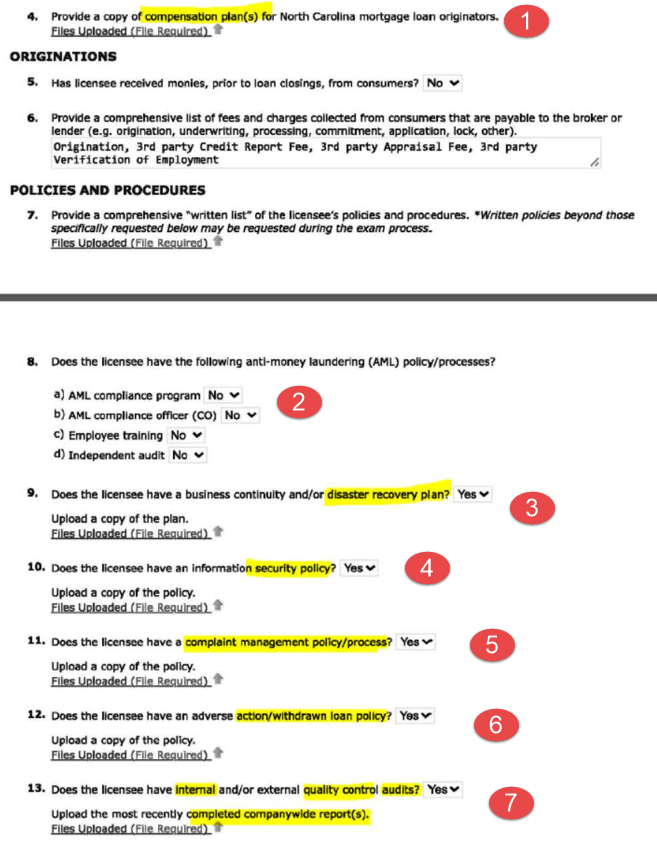

1.) Compensation Plan is what you are actually paying your LOs and yourself. Please see 2-0 Compliance > 2-71 for Plans and FORMS - Form 3-10 Loan Originator Compensation Plan

2.) a.) You have all of these elements - click yes See 1-A QC Plan > Section 1-70 AML/BSA Plan in its entirety.

2.) b.) is the name you put in under AML Officer (probably the company principal or compliance officer)

2.) c.) Annual AML training is required. You may have gotten it from your CE provider. Look at the syllabus to see what was included in your CE/PE courses. If not, take the course here: https://www.mortgagemanuals.com/401/login.php?redirect=/annual-aml-training.html

2.) d.) AML Independent Review is different from a plan, it is a 3rd party review of your materials, and how ready your company is to participate in the plan. You can order one here: https://www.mortgagemanuals.com/annual-amlbsa-audit.html

3.) Please see 2-9 IT Security > 2-97 Disaster Recovery and Business Continuity

4.) Please see 2-9 IT Security > 2-90-2-92 IT Security, Safeguarding and Data Breach

5.) Please see 2-0 Compliance > 2-80 Complaint Resolution

6.) Please see 2-0 Compliance > 2-40 Fair Lending

7.) Please see 1-A QC Plan > Section 6 Post Closing Financial and Compliance Review