New York is a difficult ticket. The regulator will tell you directly that it will take at least a year, sometimes two. One of my clients got her license in 8 months. You have to be willing to jump through a lot of hoops.

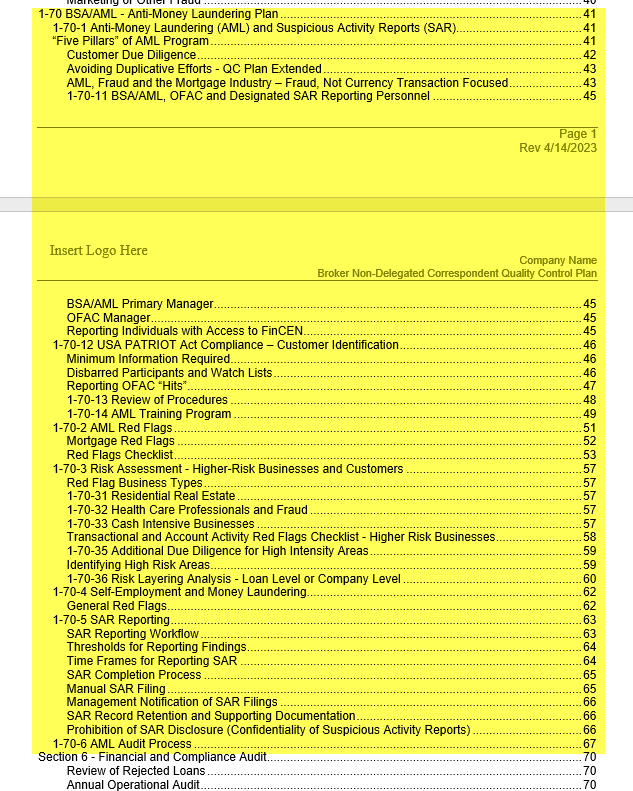

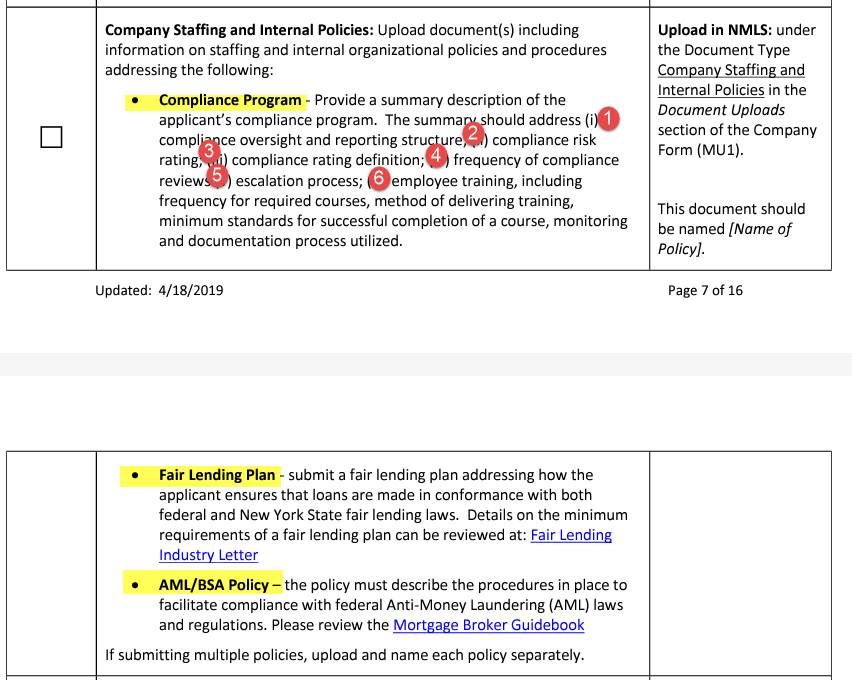

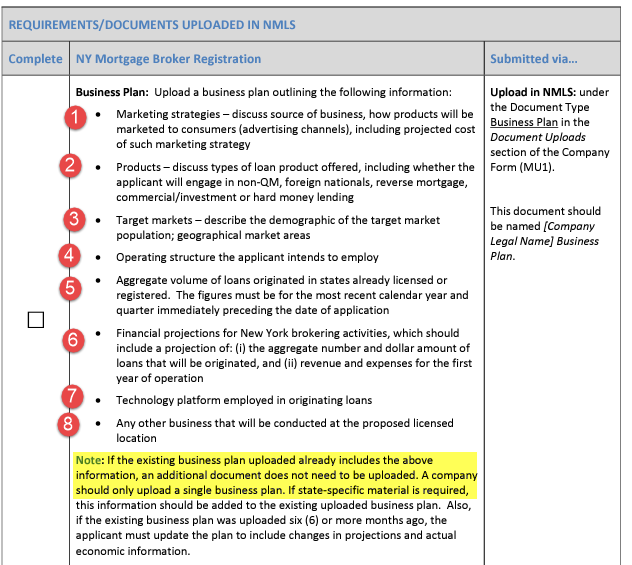

Confusion also stems from the fact that there are a series of seemingly overlapping requests. They ask for a Compliance Plan, a Fair Lending Compliance Plan, a Business Plan, and a BSA/AML Plan. Each of these requires periodic audits to ensure compliance, so be aware that you must implement them for when the regulator returns for a periodic exam, which can be every three years, more or less, depending on the results of the last audit.

One element that they do not explicitly require at application, but which you must have to conduct business, is the cybersecurity plan. We provide this as part of the package, because it is referenced in the Risk Assessment

Submitting Documents

Do NOT just submit your entire policies and procedures manuals; you must use the three we constructed for this purpose.

We pull the New York License Examination Policies materials from your policies and procedures and compact them to meet your company's size, style, and methods.

Company Staffing and Internal Policies

The phrase "Company Staffing and Internal Policies" doesn't mean anything. You have to look further at what the specific request says.

Business Plan

BSA-AML Plan

BSA/AML rules essentially extend fraud detection to suspicious activity detection. (in other words, if you're not certain it's fraud or money laundering, but it meets the thresholds, you must report it. As such, it's a natural extension of the QC Plan. You can print Section 1-70 of the QC Plan to meet this requirement.

Understanding New York's Process

One of the reasons it takes so long - numerous divisions (Legal, Fair Lending, Compliance) within the Department have to sign off on the policies. If there are questions, they don't come from the person reviewing the materials; they come through a license examiner who relays information back and forth. Since overlays and different departments exist, you might get instructions to correct something in one manual but leave it in another.

To further delay things, depending on the examiner, it appears these three reviews don't happen concurrently - they happen one at a time.

They also want to have access to your anti-money laundering program, a risk assessment, quality control plan, advertising review, website analysis, and several other things.

It is a lot of work, and it requires patience and simply moving through the process. We can help you with changes and corrections but you must understand what is being requested. If you do not, the examiner will know and will simply continue to challenge your documents.