Compliance

RESPA Loan Estimate Triggers are NOT ECOA Applications

Pre-Qualifications with a Property Address, though, MUST have a Loan Estimate

Last updated on 03 Nov, 2025

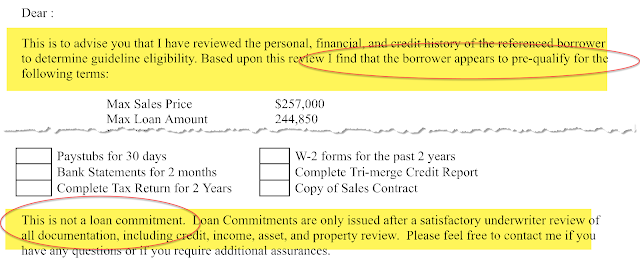

We know applications do not necessarily follow a rate inquiry with a property address. For instance, you may provide a pre-qualification letter for a specified loan amount. Does that mean you have a loan application?

What is Pre-Qualification?

"Pre"-Qualifying is a prior-to-application discussion (hence "pre-") of eligibility and rates, applied against published standard qualifying guidelines; ratios, down payment, loan type, and maybe even credit score. This analysis should result in a number: the maximum loan amount a customer could afford. It's not an application, and the result states "THIS IS NOT AN UNDERWRITING DECISION", something that you must feature prominently on any correspondence. This is so consumers don't represent or think that they have been approved when they haven't.

"Pre-Approval" with TBD (to be determined property address) may not require a Loan Estimate/GFE, BUT must have AU/DU/LP.

If you call a pre-qualification a "pre-approval", remember that the pre- is pre-property, NOT PRE-UNDERWRITING. Pre-approvals must have underwriting review, even if it is just DU/LP/AU approve/eligible.